Introduction

Oracle Receivables

provides a comprehensive solution to managing the entire life cycle of bills

receivable: creation, acceptance, remittance, updates, history, and closing.

What

is Bills Receivable?

Bills

Receivable, Commerce, Promissory notes, bills of exchange, bonds and other

evidences or securities which a merchant or trader holds, and which are

Payable

to him.

A bill receivable is a

document that your customer formally agrees to pay at some future date (the

maturity date). The bill receivable document effectively replaces, for the

related amount, the open debt exchanged for the bill. Bills receivable are

often remitted for collection and used to secure short term funding.

Definition of Bills

Receivable

·

A Bills Receivable (BR)

has characteristics of both a transaction and a receipt.

·

It is like an invoice

because it is a debit item that a customer owes you.

·

It is like a receipt,

because you can remit it to a bank to get payment

Objective :

In

Day to Day Business activities, Companies are facing various challenges with

respect to

1)

Collection Analysis and

Strategies for Chasing Late Payments

2)

Late Payments of Invoices

3)

Invoice Disputes

To

overcome this, Bills Receivable can be used as alternative which has below

features

1) More secure debit item than a regular invoice.

2) A legal document, binding the debtor (signer)

to pay a certain sum at a future day or on demand.

3) Eliminate Collection Analysis and Strategies

for Chasing Late Payments

4) Minimize Invoice Disputes

5) By entering into a BR agreement, the debtor

promises to pay the creditor the specified amount at the specified date.

Three Types Of Bills

Receivable

§ Accepted Bills Receivable (Signed BR)

§ Promissory Note (Drawee Issued)

§ Unsigned Bills Receivable

Contents of Bills Receivable

· Set-up

· Flow

· Creation

· Remittance

· BR Maturity and Risk Elimination Program

· Portfolio Management

· Summary of BR flow

· List of BR programs

· Accounting Entries

Major Setups

1) Auto Accounting

2) Transaction Types

3) Batch Source

4) Receipt Classes

5) Receipt Source

6) Remittance Banks

7) Customer

8) Customer-Drawee Site

9) Payment Details

Auto Accounting

SQL:

SELECT RAD.type,

HOU.NAME,

RADC.segment,

RADC.table_name,

RADC.constant

FROM ra_account_defaults_all RAD,

ra_account_default_segments RADC,

hr_operating_units HOU

WHERE RAD.type = 'BR_FACTOR'

AND RAD.org_id = HOU.organization_id

AND RAD.gl_default_id = RADC.gl_default_id

AND HOU.organization_id = 204

HOU.NAME,

RADC.segment,

RADC.table_name,

RADC.constant

FROM ra_account_defaults_all RAD,

ra_account_default_segments RADC,

hr_operating_units HOU

WHERE RAD.type = 'BR_FACTOR'

AND RAD.org_id = HOU.organization_id

AND RAD.gl_default_id = RADC.gl_default_id

AND HOU.organization_id = 204

Transaction Types

SQL :

SELECT *

FROM ra_cust_trx_types_all RCTT

WHERE RCTT.NAME = 'BR - Drawee Issued'

FROM ra_cust_trx_types_all RCTT

WHERE RCTT.NAME = 'BR - Drawee Issued'

Receipt Classes

Receipt Source

SQL :

SELECT arc.receipt_class_id,

arc.creation_method_code,

arm.printed_name,

arm.receipt_method_id

FROM ar_receipt_classes ARC,

ar_receipt_methods ARM

WHERE arc.NAME = ‘Unsigned Bills Receivable’’

AND arm.receipt_class_id = arc.receipt_class_id

arc.creation_method_code,

arm.printed_name,

arm.receipt_method_id

FROM ar_receipt_classes ARC,

ar_receipt_methods ARM

WHERE arc.NAME = ‘Unsigned Bills Receivable’’

AND arm.receipt_class_id = arc.receipt_class_id

Batch Source

SQL :

SELECT *

FROM ra_batch_sources_all

WHERE NAME = 'BR Automatic Numbering'

AND org_id = 204

Customer - Drawee

SiteFROM ra_batch_sources_all

WHERE NAME = 'BR Automatic Numbering'

AND org_id = 204

SQL :

SELECT HCA.account_number CUSTOMER_NUMBER,

HCA.cust_account_id, hp.party_id,

HP.party_name, hcsu.site_use_code,

HPS.party_site_number,

HCA.cust_account_id, hp.party_id,

HP.party_name, hcsu.site_use_code,

HPS.party_site_number,

HL.address1 || ' ' || HL.address2,

HCSU.status, HOU.NAME OU_Name,

HOU.organization_id, HCSU.primary_flag

FROM hz_parties HP,

hz_cust_accounts HCA,

hz_cust_acct_sites_all HCSA,

hz_cust_site_uses_all hcsu,

hz_locations hl,

hz_party_sites hps,

hr_operating_units HOU

WHERE HCA.party_id = HP.party_id

AND hcsa.cust_account_id = hca.cust_account_id

AND hcsa.cust_acct_site_id = hcsu.cust_acct_site_id

AND hl.location_id = hps.location_id

AND hps.party_site_id = hcSA.party_site_id

AND HCSU.org_id = HCSA.org_id

AND HCSU.org_id = HOU.organization_id

AND HCSU.site_use_code = 'DRAWEE'

AND HCSU.status = 'A'

AND HOU.organization_id = 204

HCSU.status, HOU.NAME OU_Name,

HOU.organization_id, HCSU.primary_flag

FROM hz_parties HP,

hz_cust_accounts HCA,

hz_cust_acct_sites_all HCSA,

hz_cust_site_uses_all hcsu,

hz_locations hl,

hz_party_sites hps,

hr_operating_units HOU

WHERE HCA.party_id = HP.party_id

AND hcsa.cust_account_id = hca.cust_account_id

AND hcsa.cust_acct_site_id = hcsu.cust_acct_site_id

AND hl.location_id = hps.location_id

AND hps.party_site_id = hcSA.party_site_id

AND HCSU.org_id = HCSA.org_id

AND HCSU.org_id = HOU.organization_id

AND HCSU.site_use_code = 'DRAWEE'

AND HCSU.status = 'A'

AND HOU.organization_id = 204

Payment Details

SQL :

SELECT *

FROM

(SELECT HP.PARTY_NAME CUSTOMER_NAME,

HCA.ACCOUNT_NUMBER CUSTOMER_NUMBER,

CUST_ACCOUNT_ID

FROM HZ_PARTIES HP,

HZ_CUST_ACCOUNTS HCA

WHERE HCA.PARTY_ID = HP.PARTY_ID) A,

(SELECT RaCustRcptMthds.CUST_RECEIPT_METHOD_ID,

RaCustRcptMthds.CUSTOMER_ID,

RaCustRcptMthds.RECEIPT_METHOD_ID,

RaCustRcptMthds.PRIMARY_FLAG,

RaCustRcptMthds.START_DATE,

RaCustRcptMthds.END_DATE,

RaCustRcptMthds.SITE_USE_ID,

RM.NAME AS NAME

FROM RA_CUST_RECEIPT_METHODS RaCustRcptMthds,

AR_RECEIPT_METHODS RM

WHERE RM.RECEIPT_METHOD_ID = RaCustRcptMthds.RECEIPT_METHOD_ID ) QRSLT

WHERE QRSLT.customer_id = A.CUST_ACCOUNT_ID

AND A.CUST_ACCOUNT_ID=1003

AND QRSLT.NAME='BR Standard Remittance'

PROCESS FLOW

Step 1: Create Transaction for Customer and Receipt

Method

SQL :

SELECT APS.trx_number,

APS.amount_due_original,

APS.amount_due_remaining

FROM ar_payment_schedules_all aps

WHERE customer_id = 1003

AND org_id = 204

AND APS.status = 'OP'

AND EXISTS (SELECT 1

FROM ra_customer_trx_all RCT

WHERE RCT.customer_trx_id =

APS.amount_due_original,

APS.amount_due_remaining

FROM ar_payment_schedules_all aps

WHERE customer_id = 1003

AND org_id = 204

AND APS.status = 'OP'

AND EXISTS (SELECT 1

FROM ra_customer_trx_all RCT

WHERE RCT.customer_trx_id =

APS.customer_trx_id

AND RCT.receipt_method_id = 1221)

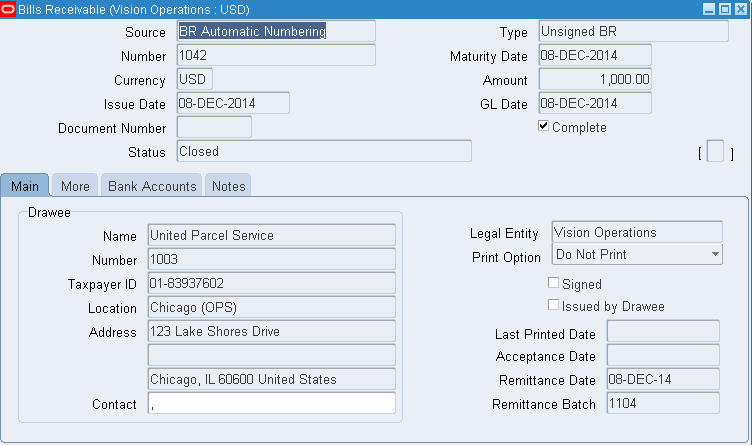

Step 2: Creation of BR.

SQL

:

1) SELECT *

FROM ar_payment_schedules_all

WHERE trx_number = '1042'

AND class = 'BR'

FROM ar_payment_schedules_all

WHERE trx_number = '1042'

AND class = 'BR'

2) SELECT *

FROM ra_customer_trx_all

WHERE customer_trx_id = 852744

FROM ra_customer_trx_all

WHERE customer_trx_id = 852744

Step 3: Click on Assignments / add transactions in

BR

SQL

:

SELECT *

FROM (SELECT trx_number,

(SELECT hca.account_number

FROM hz_cust_accounts hca

WHERE hca.cust_account_id = rct.bill_to_customer_id)

acct_number,

(SELECT status

FROM ar_payment_schedules_all aps

WHERE aps.customer_trx_id = rct.customer_trx_id

AND rownum = 1) trx_status

,

(SELECT amount_due_remaining

FROM ar_payment_schedules_all aps

WHERE aps.customer_trx_id = rct.customer_trx_id

AND rownum = 1)

amount_due_remaining

FROM ra_customer_trx_all rct

WHERE receipt_method_id = 1221

AND org_id = 204)

WHERE trx_status = 'OP'

AND acct_number = '1003'

AND trx_number IN( '1041' )

FROM (SELECT trx_number,

(SELECT hca.account_number

FROM hz_cust_accounts hca

WHERE hca.cust_account_id = rct.bill_to_customer_id)

acct_number,

(SELECT status

FROM ar_payment_schedules_all aps

WHERE aps.customer_trx_id = rct.customer_trx_id

AND rownum = 1) trx_status

,

(SELECT amount_due_remaining

FROM ar_payment_schedules_all aps

WHERE aps.customer_trx_id = rct.customer_trx_id

AND rownum = 1)

amount_due_remaining

FROM ra_customer_trx_all rct

WHERE receipt_method_id = 1221

AND org_id = 204)

WHERE trx_status = 'OP'

AND acct_number = '1003'

AND trx_number IN( '1041' )

Step 4: Complete the

BR.

Status of BR changed to Pending Remittance

Invoice selected got closed

Activities against the Invoice

Tip : For SQL, Refer query above, remove condition

trx_status=’OP’

Step 5: BILLS

RECEIVABLES à REMITTANCES

Manual Create

Click on Actions

Concurrent program is submitted and completed

BR Status has now changed to Standard Remitted

Step 6: Run Maturity

and Risk Programs

View Concurrent Requests

SQL :

SELECT ps.customer_trx_id,

ps.payment_schedule_id,

ps.due_date maturity_date,

ps.reserved_type,

ps.reserved_value,

ps.amount_due_remaining,

ps.tax_remaining,

trh.gl_date,

trh.transaction_history_id,

trh.prv_trx_history_id,

trh.status,

trh.event,

ps.org_id

FROM ar_transaction_history trh,

ar_payment_schedules ps

WHERE ps.class = 'BR'

and ps.reserved_type in ('REMITTANCE','ADJUSTMENT')

Report

Output :

Status of Bills Receivable is now Closed

Step 7: Portfolio

Management

i)

Query BR Document à Find

i)

Click History

i)

Click Details

i)

Receipt Created

i)

Click Apply

SQL

:

SELECT rap.receivable_application_id,

rap.cash_receipt_id,

rap.gl_date,

rap.apply_date,

rap.org_id

FROM ar_receivable_applications_all rap

WHERE rap.applied_customer_trx_id = 852744

AND rap.display = 'Y'

ORDER BY rap.receivable_application_id DESC;

rap.cash_receipt_id,

rap.gl_date,

rap.apply_date,

rap.org_id

FROM ar_receivable_applications_all rap

WHERE rap.applied_customer_trx_id = 852744

AND rap.display = 'Y'

ORDER BY rap.receivable_application_id DESC;

Accounting Entries

1) Invoice Created

1) Bills Receivable

Created/Remitted

1) Receipt Created

References:

https://docs.oracle.com/cd/E18727_01/doc.121/e13522/T355475T355479.htm